While optimistic, law firm business leaders may be staying awake nights worrying how the current overheated state of legal talent may impact firm profits

If law firm business leaders are facing sleepless nights, it’s likely that talent questions are what’s keeping them up at night, according to the newly released 2021 Law Firm Business Leaders Report from the Thomson Reuters Institute.

This annual report is one of the few reports in the legal landscape that focuses exclusively on the thoughts and opinions of the allied business professionals who are leading midsize and large law firms — those professionals occupying the finance and operations roles within law firm leadership. Without the duality of purpose that often comes from trying to manage a law firm while also maintaining a book of client business, these firm leaders bring a different perspective to the strategies of running a law firm.

Unsurprisingly, last year’s survey found that many of these business professionals were concerned about the broader economy and the impact it may have on future firm profitability. But after many firms posted strong results at the end of 2020, and with 2021 shaping up to be another banner year for many law firms, their concerns over the impact of economic shifts has abated.

Instead, this year’s survey found that concerns related to talent have skyrocketed into the front of firm business leaders’ minds. In fact, four of the top five areas rated as “high risk” to future firm profitability relate directly to talent considerations. The top five high risk areas identified by respondents were, in order:

- Lawyer recruitment and retention

- Poaching of staff by competitors

- Associate salary increases

- Underperforming lawyers

- Competition among law firms over fees.

And concern over these issues is being borne out in market realities.

According to the most recent Thomson Reuters Peer Monitor Index report, for example, law firms have been experiencing heavy turnover among their professional staff, particularly among associates. Associate salary increases, which have become strikingly common in 2021, have driven record growth in law firm direct expenses. And per lawyer productivity — when compared to 2019 (the last “normal” baseline year) — continues to slip.

Download your copy of the 2021 Law Firm Business Leaders Report via the form on this page.

Yet despite these risky areas, law firm business leaders remain bullish on their firms’ prospects. A majority of respondents said they expect moderate to high growth in nearly every key metric of law firm profitability and have similar expectations for demand in nearly every practice area. Perhaps this buoyant mood reflects a more general sense of optimism that the waning of the pandemic-induced struggles from the past 18 months or so will lead to better days ahead.

As firms prepare for what the future will bring, many firm business leaders report that they will be re-evaluating their firm’s use of real estate, both to accommodate a hybrid working model and to continue to take advantage of some of the expense reductions experienced in the past two years.

Lateral hiring and increasing billing rates will also be key strategies many firms will likely employ, along with a greater emphasis on improving efficiency through innovative technology.

The strategies around technology are worthy of a closer examination. For the first time, this survey bifurcated the question of greater use of technology to explore the portion of use that is designed to cut costs, as opposed to the portion of use for purposes other than to cut costs. Thus, we learned that more firms said they plan to increase their use of technology for purposes other than to cut costs.

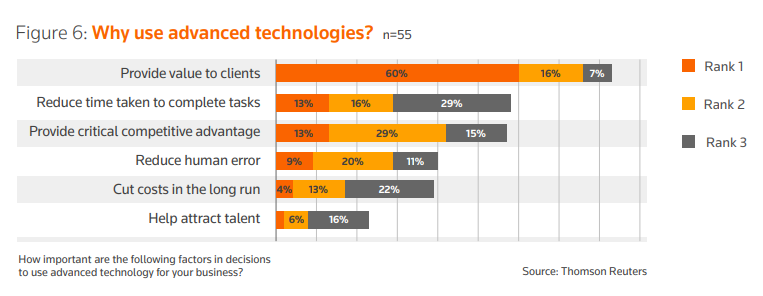

So, in what areas will tech be leveraged if not to cut costs? Looking at the firms whose leaders said they plan to either upgrade or purchase tech solutions, most uses relate to either facilitating new ways of working or enabling greater efficiency in producing work product. Firms are most likely to look at purchasing or upgrading technology for remote working, financial management, internal collaboration and client portals, market analytics, legal project management, and eBilling. On the whole, firms are most likely to upgrade their technology as a means of providing better value to clients.

Indeed, technology also provides the most fertile ground for potential law firm outsourcing, as cloud and server infrastructure, electronic discovery, and IT support were among the areas firms were most likely to either be outsourcing currently or looking to outsource in the future.

The report also details findings relating to firms’ plans for potential expansion domestically, concerns over firm culture brought on by managing a workforce split between in-person and remote workers, and how firms are trying to drive collaboration in an age of hybrid workforces.

This report was first released by the Thomson Reuters Institute and has been republished on Legal Insight with permission.