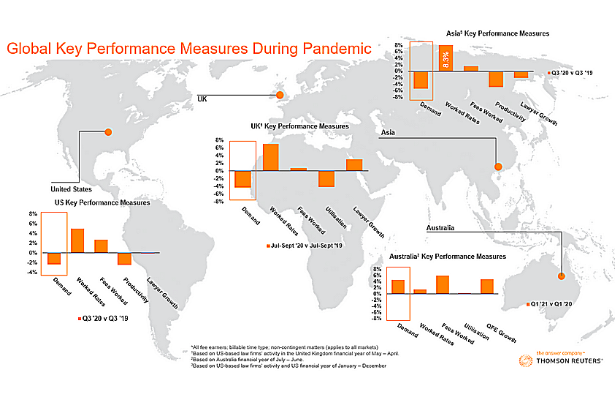

Global markets have shifted greatly in response to COVID-19. Since the onset of the pandemic nearly all businesses have had to pivot their processes and procedures in adherence with the ‘new normal’.

The legal industry was no different, and much has changed over the last 10 calendar months. Many law firms the world over have struggled in line with the overall economic decline of the countries they operate in, with the Australia market seemingly a key exception. By the end of the financial year in June the Australian legal market was the only one globally with average demand growth occurring over the pandemic affected period, and substantial growth to boot.

While the market had proven itself resilient to the downward economic pressures affecting so many other global legal markets, at the time it was unclear if this was simply an anomaly or if the broader economic success of the Australian law firm was sustainable for the first quarter of 2021 and beyond.

Legal markets compared globally

Now that Q1 has come and gone, the resiliency of the Australian legal market continues to showcase itself in the data. In the annual 2020 Australian State of the Legal Market report, it was detailed just how well the market has performed relative to other legal markets around the world. More than a quarter into financial year 2021, this trend has sustained, albeit to a slightly lesser extent.

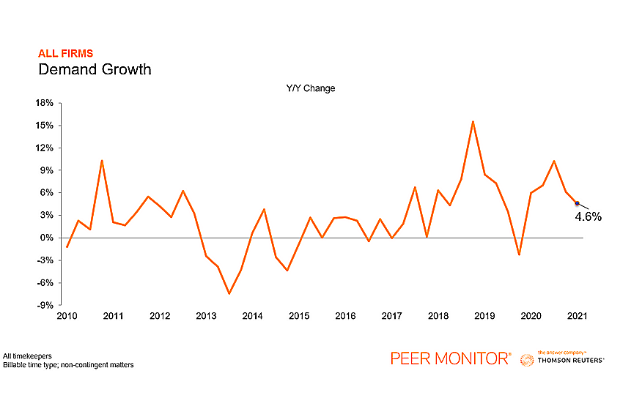

The average Australian law firm saw demand, as measured by billable hours worked, increase by 4.6% relative to the first quarter of FY2020. From a global perspective, this exceeded domestic performance of the average US firm over the same time period by seven percentage points. Further, US firms continued to struggle in the UK and Asia, with demand contracting in these regions by 4.2% and 5.4% respectively.

This was a continuation of a trend in Australia, as the market has been in a period of expansion since halfway through 2015, with only two quarters of demand contraction occurring in the last half decade.

Is Australia’s legal market following the US’?

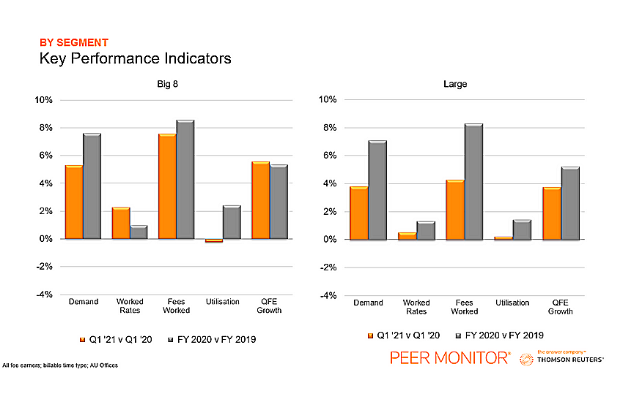

In the US, firms at the top of the market have been more insulated against demand declines thus far into the COVID-19 pandemic. In contrast, demand growth in Australia in the first quarter was not isolated to the top of the market – with both segments of the market exceeding 3.5% demand growth in Q1.

While worked rates increased in both segments by similar amounts in FY 2020, Q1 told a slightly different story. Worked rate growth in Q1 amongst firms in the Big 8 exceeded that of the average large firm by almost 2.0%. This was largely driven by changes in firm structure within the segment – with the proportion of hours worked by lower fee commanding non-lawyer fee earners significantly decreasing at Big 8 firms in Q1.

“Lawyer growth slowed somewhat at firms in the large segment in the first quarter. This is more in line with what we have seen globally, where firms have tried to balance supply of lawyers with market demand in the face of an uncertain future.”

– Joe Blackwood, Senior Thought Leadership Analyst, Peer Monitor

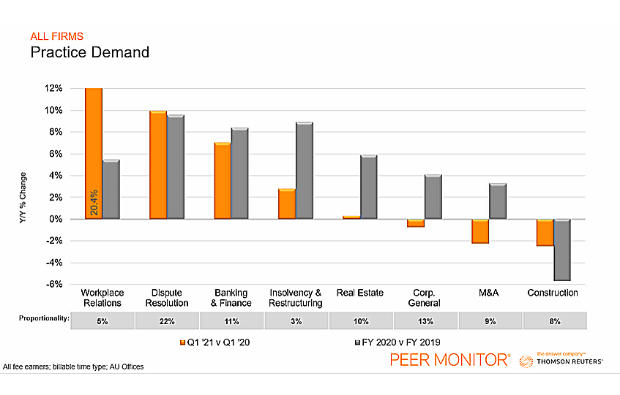

Demand in the market was buoyed by three practices in the first quarter: Banking and Finance, Dispute Resolution, and Workplace Relations. All three practices exceeded 6.0% demand growth in Q1, with workplace relations work increasing by an average of more than 20.0%. Together, these three practices make up approximately 38% of all hours worked.

Where firms are cutting costs

One major area of similarity for the average Australian law firm and their global counterparts was expenditure. Expenses have been trending downwards in all markets since the onset of the pandemic, with overhead expenditures first and most affected thus far.

Indirect expenditure was down 3.4% on a rolling-12-month basis by first quarter’s end, with reductions in office expenses and marketing and business development the leading areas of contraction. Office expenses (spend down 23.1% per qualified fee earner over the last 12 months) have been down sharply as a result of a shift to work-from-home for many firms, while marketing and business development (spend per QFE down 42.7% over the last 12 months) has been most severely affected by significant reductions in travel and event cancellations.

Direct expenditure, which ended FY2020 comfortably in growth territory, has seen growth sharply dip in line with payroll forgiveness programs being offered during the pandemic and some signs of headcount growth slowing in Q1. If the trend of lawyer headcount reduction compounds, direct expenditure is to join overhead expenditure in contraction by Q2’s end.

What will come next

While firms in the market continued to vastly outperform their global counterparts in Q1, there are some signs of waning confidence in the long-term sustainability of market demand growth.

“Some firms in Australia have begun to slow hiring like firms abroad, and demand growth has shown signs of slightly slowing.”

– Joe Blackwood, Senior Thought Leadership Analyst, Peer Monitor

While vaccine distributions have begun as of writing this, it is yet unclear how fast distribution can occur on a global scale. Market performance in the US and elsewhere is largely contingent on a return to ‘normal’, which is predicated to occur somewhere around midyear 2021. The Australian legal market will be closely monitored in the meantime to see if it can continue to buck the trend of demand contraction seen elsewhere globally.