It seems that everyone in the legal market has been hit over the head with commentary around how the emerging uncertainty, anticipated market fallouts, and every negative impact of the COVID-19 pandemic will force massive change on the industry.

While likely, it’s important to remember that not all uncertainty needs to be greeted with tightening one’s belt and weathering the storm.

Uncertainty does typically lead to new risks, of course, risk is two-dimensional. There’s the obvious downside, negative impacts of risk — that feeling of careening down a hill with no brakes that, let’s say, an imminent economic recession could bring on. But there’s the less talked about upside risk — the potential for positive gains to propel your law firm into a new market position during these times of uncertainty.

Let’s talk about those.

Step 1: Gamblers don’t gamble

How law firms decide to invest their resources of talent, technology, and more is usually (and most successfully) based on data. When managing the mix of your firm’s business, it is not the time to solely rely on gut instinct or luck.

Data is critical. Correction: the right data is critical. And that data needs to include insight into multiple factors, such as:

Market factors — Market factors are the universal conditions that impact everyone — all law firms and all clients. The world moving to a remote working environment is a great example of a true market factor. For law firms, the risk is in how well you react to a new market factor.

Acritas, now part of Thomson Reuters, is currently conducting ongoing pulse interviews with general counsel to monitor the most up-to-date changes in how legal decision makers are thinking. And, based on this on-going survey, many general counsel we spoke to said that not all law firms were ready for or responded well to remote working in an effective manner.

So, what other market factors are GCs telling us are on the horizon? (And more importantly, what data do you need now to avoid the risk of scrambling in the coming weeks?) Here’s some examples:

- Reopening of workspaces;

- Concerns around a potential global recession; and

- Implications of increased digitalization on existing business processes.

Interestingly, while market factors affect everyone, they don’t typically comprise the bulk of what clients are managing on a day-to-day basis. Most corporate law departments direct their efforts to industry-specific and business-specific factors.

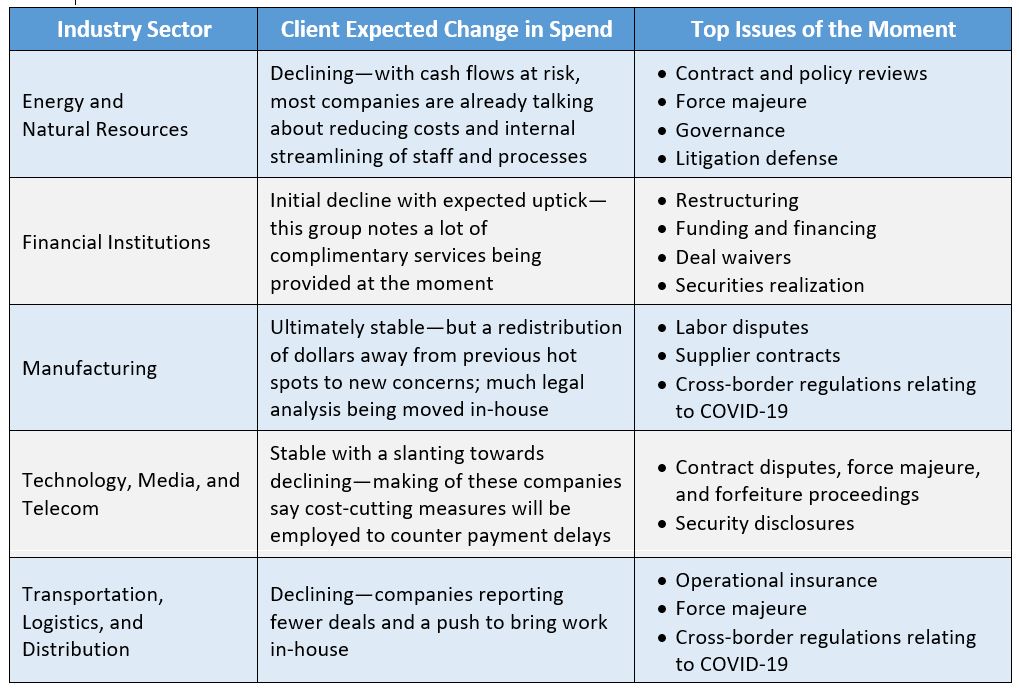

Industry-specific factors — So far, the more than 100 responses to our pulse survey make one result abundantly clear: not all industries are being impacted in the same way. Spending trends, for example, are inconsistent, and top needs are as varied as the industries themselves.

While far from a comprehensive list, below is a snapshot of what we’re beginning to hear from corporate law departments.

The risk for law firms here is to properly diversify your firm’s investment of resources. You don’t want to be too reliant on those industries bracing for extreme cutbacks. Pivot your resources and business development efforts to focus on those companies expecting an uptick in matters and spend. Work with clients in other industries on streamlining and reducing costs, while keeping competitors out of your playing field. The point is, develop a map that’s based on where clients are heading so you know which direction to move.

Client-specific business factors — Even trends within an industry can be divergent based on company-specific factors, which explains why we’re already starting to hear pushback from clients around firms sending out information that is too generalized. Indeed, as organizations move from dealing with big-picture concerns to sorting out the minute details of what’s best for their company, what they need from external counsel changes.

The risk for firms, of course, is not knowing when to shift the conversation from thought leadership to true advice. But making this shift at the right time is the defining factor for getting your clients’ attention to… or being tuned out. The information that resonates most with individual clients is going to be impacted by a number of factors, such as:

- What does liquidity and financing look like for the organization based on its internal investments leading up to the crisis?

- Did the company have a solid crisis management plan in place or is it still in the initial emergency response stages?

- Where does the company have facilities and offices located?

If you don’t know the answers to these questions, set up a meeting with your top clients to get yourself up to speed. The answers will tell you where your client is going to need the most help, and what their financial situation is shaping up to be. If you do know the answers to these questions, press pause on the market-wide webinars and newsletters, and instead host a client-specific (virtual) roundtable where you can really help the client start addressing its business issues.

Firm-specific risk — Finally, there are the firm-specific risks. Much like client-specific risks, there are a number of factors such as financing and compensation structures, crisis preparedness, competitor movement, and (ironically) the firm’s risk threshold that will play a large role in what response will provide the most upside potential.

The biggest risk for firms here is to trust your gut instead of the data. It’s easy to do, especially when it’s your own firm, but resist the urge to ignore what the data can tell you. When understanding the likelihood of success in following an opportunity, it’s important to benchmark your firm’s performance against peers and industry leaders that you will be trying to unseat for access to new work.

Step 2: Backing the Right Horse

Before you decide on what action your firm should take, it’s important to be extremely clear about the firm’s goals. And goals during uncertainty are hard to solidify (this goes back to what I was saying about firm-specific risk tolerances). Is your partnership more conservative and focused on preservation and steady survival through rocky times? Or, are you motivated by growth and building the bottom-line value of your firm to fuel market share gains?

I can’t answer this question for you, but I can say from experience that the only strategic initiatives I’ve seen succeed spoke to the culture of the firm. Firms are well-served by leaning into those strategies more aligned with their culture and overarching goals.

For example, one of the cornerstones of ensuring long-term preservation of the firm is to pursue high client retention. The firms that have been most successful at standing the test of time have circled the wagons around their most strategically important clients by using client feedback and high-performing client teams to ensure competitors don’t poach their key clients.

On the other hand, firms that look to use current conditions to propel their firms into stronger market positions are exceptionally nimble at pursuing strategically targeted opportunities. This typically comes in the form of industry-focused teams and creating innovative approaches to solving new client needs.

Since many firms have limited time and funds to invest in strategic initiatives, understanding the objective early enables you to balance the return you are expecting against the risk in adopting a new approach.

Once you have accurate data, it naturally becomes easier to identify the risks — both downside and upside — that are facing your firm. Which begins to lay the foundation of how to develop a more successful plan of action.

The author of this article is Jen Dezso, Vice President of Acritas US Inc. Jen’s article was originally published by Legal Executive Institute, the Thomson Reuters thought leadership forum.