Regulators will seek evidence of a nuanced and comprehensive transaction monitoring program when they undertake supervision and enforcement work, Australia’s top anti-money laundering (AML) lawyer has warned.

Sonja Marsic, senior executive lawyer at the Australian Government Solicitor, told a recent industry forum that an effective transaction monitoring program should sit at the heart of every financial institution’s AML and counter-terrorism financing (CTF) compliance program.

Transaction monitoring failures were common to all of the major enforcement cases that had reached the courts in Australia, she said.

Marsic was the leading solicitor in all three of the Australian Transaction Reports and Analysis Centre’s (AUSTRAC) civil litigation cases. She led the AML/CTF regulator to more than A$2 billion in settlements in its court actions against the country’s two largest banks and its largest gambling company.

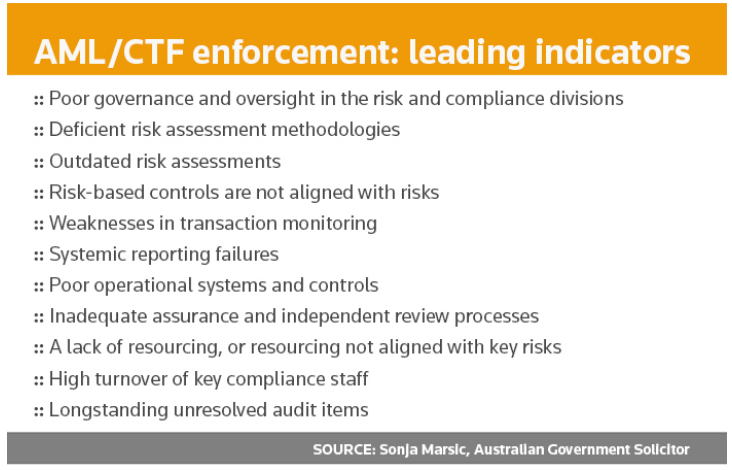

AUSTRAC and other regulators across the Asia-Pacific region will typically look for a series of indicators when they make assessments on whether to pursue supervision and enforcement activity. Some of the leading indicators include weaknesses in transaction monitoring and a corresponding breakdown in transaction reporting. The reporting failures may include missing or delayed suspicious matter reports, threshold transaction reports and cross-border funds transfer reports.

These failures are exacerbated by poor internal systems and controls, inadequate staffing levels and breakdowns in the assurance and independent review channels.

The failure of a transaction monitoring system could quickly lead to vast numbers of breaches, as seen in the Tabcorp, Commonwealth Bank and Westpac enforcement cases. In addition, the failure of transaction monitoring could leave the organisation to blind to systemic and emerging risks, Marsic said.

“Once transaction monitoring isn’t working in an organisation, I think the entity can find itself in a situation very quickly where it just doesn’t understand the risks that it’s facing day-to-day in the business and it’s not able to respond. That’s one of the reasons why transaction monitoring does come in for a lot of attention from regulators,” Marsic said.

During supervision and enforcement assessments, regulators and lawyers will typically want to see evidence that the transaction monitoring program covers all of the designated services that the business provides. At the same time, the program needs to be responsive to emerging threats, changing customer behaviour or new product offerings that may give rise to a different AML/CTF risk landscape.

“Transaction monitoring programs should be designed so that they appropriately cover the breadth of all designated services that are being provided by the particular entity,” Marsic said.

“So, the transaction monitoring can’t just focus on higher risks. It does need to have a reasonable amount of coverage.”

At the Australian Government Solicitor, Marsic provides both litigation and an advisory support to government departments in the areas of AML/CTF regulation, financial regulation, civil regulation and consumer law. She has a special interest in statutory interpretation and has also assisted the Financial Services Royal Commission and the HIH Royal Commission.

Further reading:

How an informant and a messaging app led to huge global crime sting

Australian senators push for inquiry into money laundering laws