In our biennial report on the ALSP market, we find a sector that has grown exponentially over the past two years and is making great in-roads with both law firms and corporations.

The market for alternative legal services providers (ALSPs) is showing itself to be a highly dynamic part of the overall legal ecosystem and one that is growing at an increasing rate as it forges new paths to serving both traditional law firms and corporate law departments.

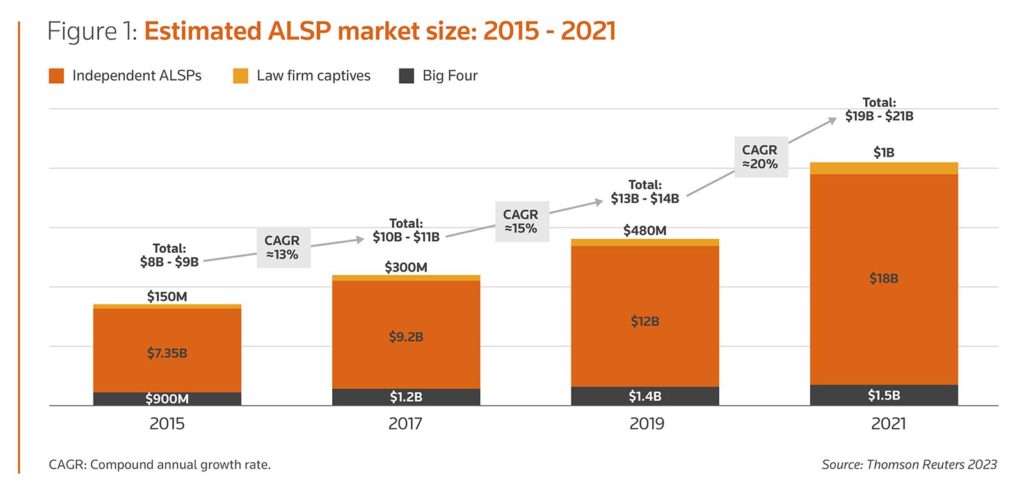

Indeed, ALSPs now comprise a $20.6 billion segment of the legal market, according to the Alternative Legal Services Providers 2023 Report, published today by the Thomson Reuters Institute, the Center on Ethics and the Legal Profession at Georgetown Law, and the Saïd Business School at the University of Oxford.

The biennial report shows that ALSPs experienced a compounded annual growth rate (CAGR) of 20% from 2019 to 2021, a significant jump from the 15% CAGR recorded between 2017 and 2019. Overall, it reveals an evolving legal market in which the boundaries between alternative legal services providers, law firms, corporate law departments, and even technology and software firms are rapidly blurring.

“Both law firms and in-house counsel are increasingly seeing the value of alternative legal services providers,” said James W. Jones, a senior fellow at the Center on Ethics and the Legal Profession at Georgetown Law and the report’s lead author. “Meanwhile, ALSPs are expanding the services they offer to law firms and corporate law departments by providing specialized services, improving cost efficiency, and delivering greater flexibility in headcount.”

A dynamic market

While independent ALSPs are the largest segment of the market, representing 87% of all ALSP revenue, captive ALSPs — those owned by law firms — are a smaller segment, but it’s also the fastest-growing, posting a six-fold increase since 2015, the report notes. ALSP services from the Big Four consulting firms also account for a portion of this market.

The growth in this market is not surprising given that an increasing percentage of law firms of all sizes expect to either maintain or increase their outside spending on ALSP services. Among the largest law firms, 26% said they plan to increase spending on ALSPs, while only 3% foresee decreased spending on these providers.

Among corporate law departments, the picture is a bit more mixed. Those departments that are not currently using ALSPs report an increased interest in doing so; yet, among departments that already use ALSPs, 21% said they plan to increase their ALSP spend, while a roughly equal percentage (22%) said they are either decreasing or are uncertain of their spending plans on ALSPs. This apparent dichotomy may suggest that corporations and their law departments may have reached an inflection point of sorts that is causing them to reassess the value and potential uses of ALSPs, according to the report.

Increasing ALSP usage

The report also illustrates how law firms and corporate law departments have been aggressively exploring the ways in which they could better utilize ALSPS in their own legal work, whether than involves pulling in ALSP experts in project management, technology, or consulting. Further, it shows that many large and midsize law firms have become increasingly aware of the ability of ALSPs to help them retain their best corporate clients, with substantially larger percentages of survey respondents citing this benefit compared to two years ago.

Indeed, ALSPs have been employed in consulting on legal technology at a fast-growing rate, the report shows, with the most common uses for ALSPs in this area being technology support, technology training, and expertise around what legal technologies are available.

The report reveals an evolving legal market in which the boundaries between alternative legal services providers, law firms, corporate law departments, and even technology and software firms are rapidly blurring.

More than one-half of large law firms use ALSPs for consulting on legal technology — in fact, it was that segment’s second-most common reason to use an ALSP, according to the report. More than one-third (37%) of midsize law firms and 31% of small law firms also use ALSPs for legal tech consulting. Given that utilization, this legal tech use case looks to be a very promising avenue of business for tech-savvy ALSPs.

“ALSPs are demonstrating value in helping law firms identify and implement the right technology solutions as well as providing training and support,” said Michael Abbott, head of the Thomson Reuters Institute. “The ALSP market increasingly includes software companies and providers of comprehensive legal technologies.”

The report is based on an online survey of contacts in decision-making roles at law firms and corporate law departments in the United States, United Kingdom, Canada, the European Union, and Australia. In total, 649 respondents (407 law firms and 242 corporations) completed initial survey questions related to the use or non-use of alternative legal services providers, and a total of 349 respondents completed at least one section related to an alternative legal service.

Access your copy of the Alternative Legal Services Providers 2023 Report via the form on this page.

This article was originally published on the Thomson Reuters Institute, and features on Insight with permission.