Thomson Reuters Regulatory Intelligence has launched its 13th annual survey on the cost of compliance for regulated firms in the financial services industry.

The cost of compliance survey report has become the trusted and acknowledged voice of the industry and the frank concerns and views shared by participants have consistently given an insight into the reality and challenges faced by risk and compliance practitioners.

The survey questions cover the swathe of challenges facing compliance functions and include the continuing ramifications of the pandemic, what the ‘ideal’ compliance function now looks like, regulatory change, the impact of technology, an insight into budgets together with culture and conduct risk concerns and personal accountability.

Indeed the 2021 cost of compliance report gave an unparalleled insight into the approach of compliance functions in Asia. There remains no doubt that compliance functions have risen to the challenge of the pandemic and the crisis has shown that firms can change and adapt at speed, but challenges still exist, and the 2021 report considered those challenges. Challenges which could also be seen as additional, practical, drivers for change in their own right.

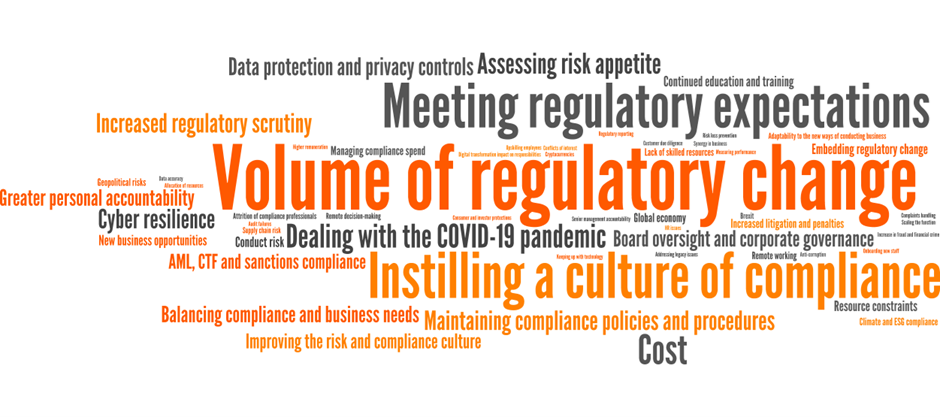

One of the major challenges for compliance is the sheer expected volume of continuing regulatory change. The greatest compliance challenges the board expects to face in 2021 are:

Sixty seven percent of firms in Asia, and 77% of firms in Australasia, reported expecting the volume of regulatory information to increase in the coming year. This is comparison to 78% of firms on a global basis expecting the volume of regulatory information to increase.

A key feature of the challenges ahead and both a driver and enabler of change is technology. Without the rapid and successful deployment of technology financial services firms would not have been able to invoke wholesale remote working for their employees.

The use of technology and new ways of working could bring opportunities to banks amid the pandemic situation, but they could also pose new challenges which do not exist in the traditional face-to-face environment.

Alan AU, Executive Director of Hong Kong Monetary Authority. November 2020

APAC is seen to have embraced technology ahead of the rest of the world. In terms of regtech solutions affecting the management of compliance, 49% of firms in Asia and 44% in Australasia reported deploying regtech. This is well ahead of the global figure of 34%.

Perhaps unsurprisingly the biggest compliance challenge arising from the pandemic is seen to be remote working. Alongside that 65% of firms in Asia and 71% of firms in Australasia expect more compliance involvement in cyber resilience – again ahead of the global figure of 62%.

The 2022 survey results will again highlight trends and regional comparisons, allowing firms to benchmark their views against compliance peers, whilst gaining insight into the direction the role of compliance is taking within the industry.

The findings of the report are intended to help regulated firms with planning, resourcing and direction, and to allow them to determine whether their resources, strategy and expectations are in line with the wider industry. The experiences of Global Systemically Important Financial Institutions (G-SIFIs) are analyzed separately where these can provide a sense of the approach taken by the world’s largest financial services firms.

All information will be treated in the strictest of confidence and results will be displayed anonymously.

The results will form part of a special report on the cost of compliance which will be available to download in Q2 2022.

Thank you for your participation in the 13th annual cost of compliance survey.